High dividend yields can be a great way for investors to generate valuable income from their portfolios. Companies use a portion of their earnings to pay back investors, and those funds can be used to reinvest or for life expenses. But high yields can also be a warning sign that something is going wrong with a company's operations.

If you know where to look, there are stocks with high dividend yields that still have room to grow. I think AT&T (NYSE:T), MGM Growth Properties (NYSE:MGP), and Brookfield Renewable Partners (NYSE:BEP) are companies that fit this description, are misunderstood for a variety of reasons, and are now three top high-yield dividend stocks available today at rock-bottom prices.

1. AT&T: The wireless giant

The telecommunications industry hasn't been a favorite of Wall Street lately, and AT&T hasn't done itself any favors with a number of missteps at Time Warner and the HBO Max launch. But that doesn't mean the company isn't a great dividend stock long-term.

[Breakthrough: The World’s Most Successful Tech Giants are Buying into this Emerging Field]

Wireless is the company's core, accounting for $17.1 billion of the $41.0 billion in revenue the company generated in the second quarter. And with 5G communications ramping up this year and next, there's an opportunity to grow the business as new devices are connected and consumers upgrade to faster networks. Segments like entertainment and the Time Warner studios were hit harder by the shutdown of movie theaters and other COVID-19 effects, but they'll return to form in time.

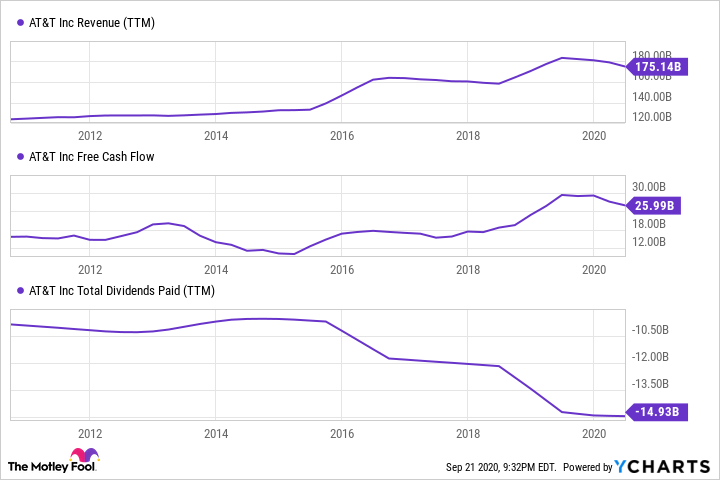

Ultimately, the reason to own AT&T long-term is the dividend. You can see that the company generates tens of billions in net income each year and that fully funds the dividend.

(source: fool.com AT&T REVENUE (TTM) DATA BY YCHARTS)

(source: fool.com AT&T REVENUE (TTM) DATA BY YCHARTS)

While there are some weaknesses in AT&T's business in the entertainment and Time Warner segment, those businesses should improve over time. Despite its flaws, HBO has high-quality content and HBO Max is considered one of the long-term streaming contenders. Add in the stability of the wireless business, and this is a 7.3% dividend yield that's a great buy today.

[Big Money: Google and Microsoft Just Put Over $4 Billion into this New Technology]

2. MGM Growth Properties: Gamble on this REIT

There has been a lot of uncertainty for real estate investment trusts (REITs) in 2020. Those in the hotel and entertainment industries are especially concerned because business has been crushed by a reduction in demand caused by the COVID-19 pandemic. Naturally, it's easy to think that MGM Growth Properties is in trouble given that its rent is coming from casino operator MGM Resorts (NYSE:MGM). But the casino business has been surprisingly resilient over the last few months.

In July, gambling revenue on the Las Vegas Strip was down just 39% versus a year ago, and even hotel occupancy was decent at over 40%. And the number of resorts open and the number of visitors coming in the door keep going up over time. There's no indication that Las Vegas is at a standstill, and that means rent will keep coming to MGM Growth Properties.

Even for a REIT, MGM Growth Properties' dividend yield is high at 7%. But I think the gambling business is more stable than the market is assuming right now, and that's why a high yield like this is still a buy.

3. Brookfield Renewable Partners: A great renewable energy dividend

In energy, the highest growth segment is renewable energy, and the nature of wind and solar assets requires a lot of upfront investment. But the benefit is that assets usually come with 10- or 20-year contracts to sell electricity to utilities. In effect, these are like long-term bonds that companies like Brookfield Renewable Partners are buying.

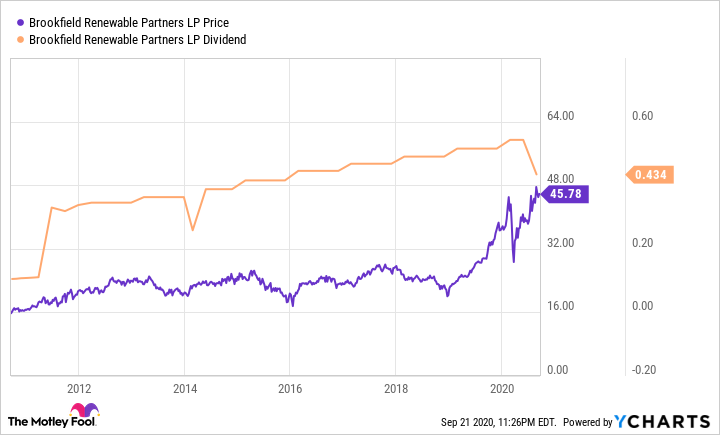

What makes Brookfield Renewable Partners unique is that it grows the business organically. The company aims to grow the dividend 5% to 9% each year by buying new projects that grow cash flow with excess cash generated by the business. You can see below that the dividend has been growing steadily for more than a decade.

[Breakthrough: The World’s Most Successful Tech Giants are Buying into this Emerging Field]

(source: fool.com BEP DATA BY YCHARTS)

(source: fool.com BEP DATA BY YCHARTS)

A dividend yield of 4.3% isn't the highest you'll see on the market, but if the payout grows at 5% to 9% for decades to come, this will grow into an extremely high yield for investors. And that's why this is a great dividend stock.

Great dividend stocks today

Not only do AT&T, MGM Growth Properties, and Brookfield Renewable Partners have high dividend yields, they have great businesses backing them up. That's ultimately what makes these stocks great buys today and what will keep their dividends growing in the long term.

[Read On: Discover What Bill Gates is Calling the “Holy Grail” of Modern Tech]

Read more from Travis Hoium at Fool.com

Travis Hoium owns shares of AT&T. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.