Sometimes a single company can send shockwaves through the entire market.

An ominous sentence from an earnings call can blow up a sector.

Or a positive outlook from one bellwether can lift the shares of its peers.

And there are very rare moments when a single company’s innovation can be horrifically destructive to its competitors, as well as provide an extraordinary bounce higher for every other industry.

We witnessed one of these exceptional occasions last week.

And one of my favorite sectors for 2021 is about to catch fire.

The $760 Million Game Changer

Last Wednesday, Abbott Laboratories (NYSE: ABT) sparked havoc.

The entire COVID-19 testing ecosystem was suckered with a haymaker as the U.S. Food and Drug Administration (FDA) granted emergency approval of the company’s $5, 15-minute rapid COVID-19 test. And the positive news didn’t stop there.

[Exclusive: Man Who Made EIGHTEEN 1,000% Recommendations Unveils #1 Stock]

Hours later, the U.S. government awarded Abbott a $760 million contract for 150 million of its BinaxNOW tests. Essentially, the federal government is purchasing almost the entire supply of tests Abbott will produce this year.

The company is producing 50 million per month starting in October.

Here’s the deal… BinaxNOW is potentially a game changer. The test is completely self-contained and doesn’t need any other equipment to administer. That means a large number of tests can be done simultaneously. And it uses lateral flow technology, similar to pregnancy tests. But instead of identifying a hormone, it reacts to an antigen.

Shares of Abbott obviously spiked on the news.

But the rest of the COVID-19 testing ecosystem was obliterated.

Shares of Co-Diagnostics (Nasdaq: CODX), GenMark Diagnostics (Nasdaq: GNMK), Fluidigm (Nasdaq: FLDM), Fulgent Genetics (Nasdaq: FLGT), Luminex (Nasdaq: LMNX), Quidel (Nasdaq: QDEL) and Quest Diagnostics (NYSE: DGX) were hit hard on the news.

For Fluidigm, this was an abrupt reversal of fortunes. The company’s shares rocketed higher on Wednesday as the FDA greenlit Fluidigm’s own COVID-19 test. But those gains were instantly wiped out by Abbott’s approval only hours later.

But for investors, the biggest potential upside isn’t with Abbott or any of these beaten-down biotechs. Instead, the upside is BinaxNOW triggering a rally in some of 2020’s worst performers.

Buy Now While They’re Still Cheap

The pandemic has been a nightmare for travel stocks.

We’re all at home, viewing the world from afar through screens and mobile devices. Airlines reduced their routes by as much as 90%.

[Extra: They Laughed, Yet FIVE of the Stocks He Named Went on to Soar Over 1,000%]

The Australian airline Qantas said the pandemic cost it $2.9 billion as its profit collapsed more than 90%. It stated a couple of weeks ago that it didn’t believe international travel would rebound until mid-2021.

Travel and leisure stocks have been destroyed this year.

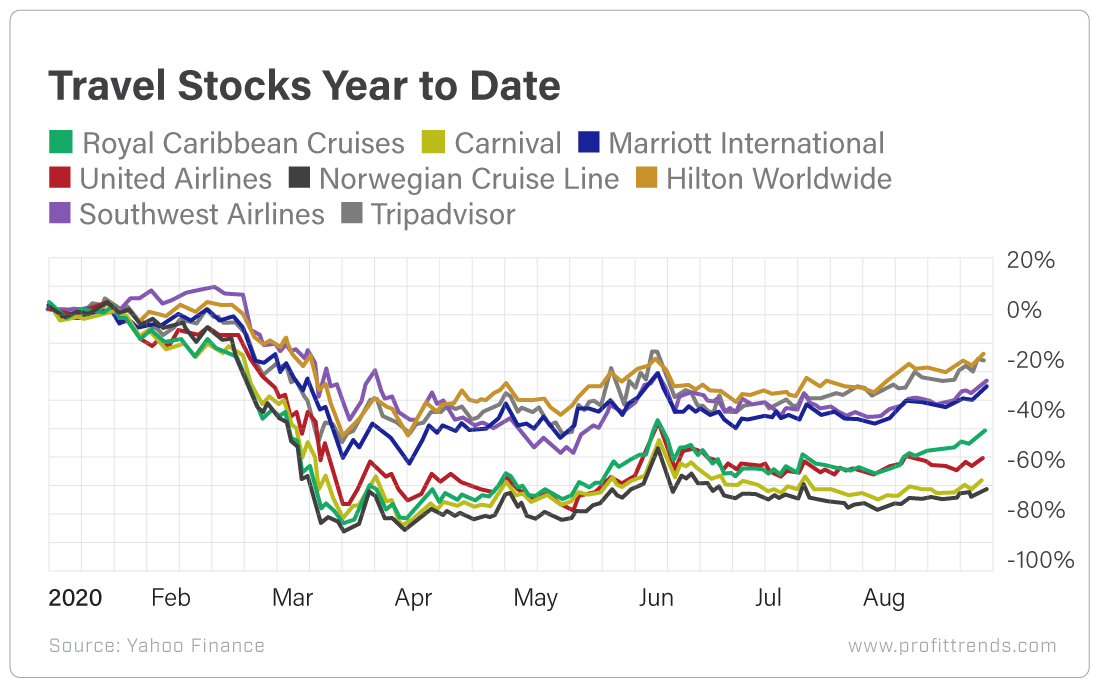

Shares of Carnival (NYSE: CCL), Norwegian Cruise Line (NYSE: NCLH), Royal Caribbean Cruises (NYSE: RCL) and United Airlines (Nasdaq: UAL) are each down more than 45% year to date.

Meanwhile, shares of Hilton Worldwide (NYSE: HLT), Marriott International (Nasdaq: MAR), Southwest Airlines (NYSE: LUV) and Tripadvisor (Nasdaq: TRIP) are still showing declines of more than 15% this year.

[Read On: Legendary Stock-Picker May Have Cracked the Code to 1,000% Gains!]

These travel stocks are a wasteland of losses that only the bravest of investors are venturing into.

But Warren Buffett’s famous adage “Be fearful when others are greedy and greedy when others are fearful” doesn’t apply only to the overall market. It also applies to specific sectors.

There are plenty of overvalued companies at this moment in time as the Nasdaq and S&P 500 are setting record highs. And some days it feels nearly impossible to find opportunities that are trading at a discount to future growth.

But these stocks are some of those opportunities. Investors can buy shares for cheap with the prospect of better days ahead.

And as the news of Abbott’s BinaxNOW approval decimated its COVID-19 testing competition, it’s started to trigger a rally in travel and leisure stocks, as well as restaurants.

As I’ve repeated a multitude of times this year, tech has been king in 2020. That’s without question.

But 2021 is going to be all about travel. It’s going to be all about experiences. There will be a year’s worth of pent-up wanderlust that needs to be released.

So for investors looking to buy cheap with plenty of growth on the horizon, travel stocks are the place to be. And rapid COVID-19 tests like Abbott’s are paving the way for them to take off.

Here’s to high returns,

Matthew

[Exclusive: Man Who Made EIGHTEEN 1,000% Recommendations Unveils #1 Stock]