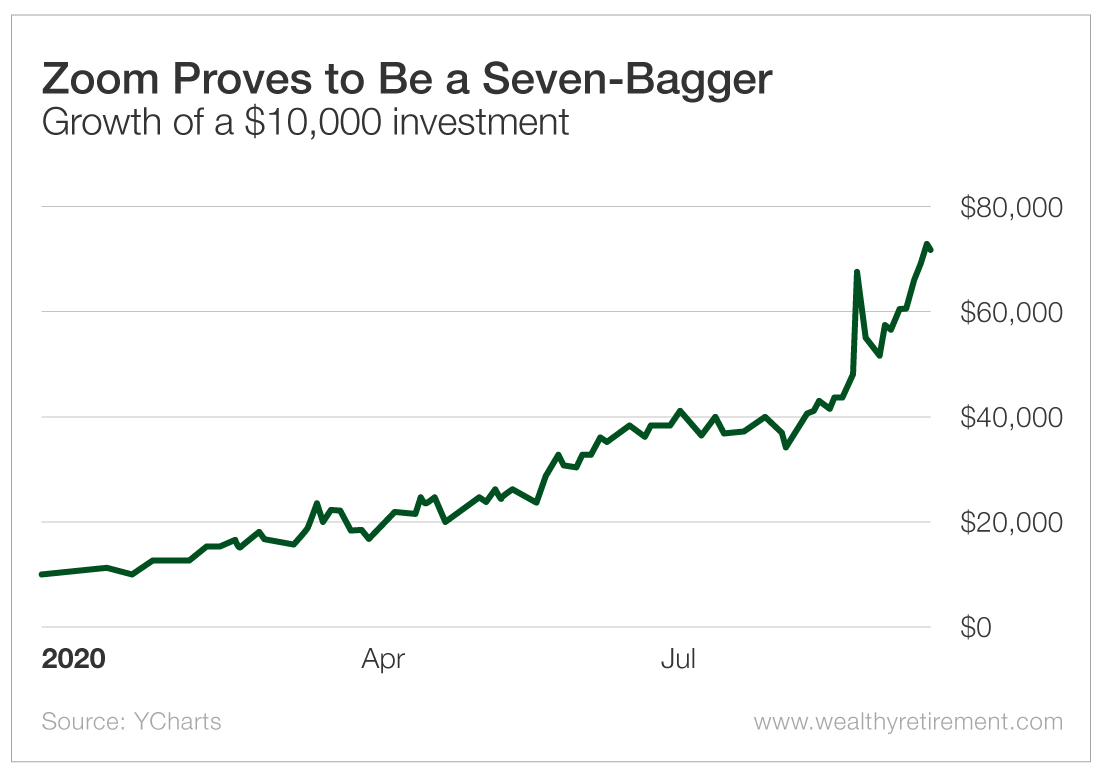

Zoom Video Communications (Nasdaq: ZM) has been nothing short of a stock market sensation in 2020.

It entered the year at $68. Now it trades for more than $480.

That is what we call a “seven-bagger” in this business.

(source: wealthyretirement.com)

(source: wealthyretirement.com)

If you owned $10,000 worth of Zoom shares on January 1, those shares are now worth more than $70,000.

I most definitely wish I had owned shares of Zoom on January 1 and held through today…

[Alert: New Technology Could Put Millions Out of Work while also Creating Many Millionaires]

But if I did, I can tell you the first thing I would do…

I would sell them. Immediately.

Zoom’s Spectacular Run

I don’t dislike Zoom’s business. Quite the contrary, actually.

Zoom produces what is widely believed to be the best videoconferencing software on the market. With the pandemic forcing everyone to work from home, Zoom was in exactly the right place at exactly the right time.

In 2020, businesses across the globe have scrambled to conduct meetings from home. Zoom has been the videoconferencing service of choice.

The result? Zoom’s 2020 revenue growth has been incredible. In the first quarter, it posted $328 million (up 169% year over year), and in the second quarter, it earned $663 million (up 355% year over year).

Those terrific results have justifiably driven Zoom’s stock price higher.

Even better, Zoom is not some profitless growth story. This is a high-profit-margin business that sees revenue growth actually turn into positive cash flow.

In the second quarter, Zoom had free cash flow of $373 million.

What I’m telling you is that Zoom offers a great service and has a profitable, free-cash-flow-generating business that is growing rapidly.

[Breakthrough: New Tech Outside the Mainstream of Ai, 5G, and Robotics Seeing Massive Gains]

So why do I think investors should sell any shares of Zoom that they own today?

Reason No. 1: Zoom’s current valuation is crazy expensive relative to the cash flow that the business generates.

Reason No. 2: There is nothing stopping much more powerful competitors from offering a superior or equal product and eating Zoom’s lunch.

A Deadly Combination

As Zoom’s stock price has soared, so too has its stock market valuation.

At Zoom’s current share price, the stock market values the company at $138 billion.

(source: wealthyretirement.com)

(source: wealthyretirement.com)

To judge whether $138 billion is expensive, compare the cash flow and earnings that the business generates.

[Discover: Learn the Real Reason the Rich Get Richer and Ensure You Don’t Get Left Behind]

Last quarter, Zoom generated cash flow of $373 million. On an annual basis, that equates to almost $1.5 billion.

That is a lot of cash flow, to be sure – but relative to Zoom’s $138 billion market valuation, it really isn’t.

All of Zoom’s valuation metrics look incredibly expensive. It sports a price-to-earnings ratio of 538 and a price-to-cash-flow ratio of 92.

These expensive valuation multiples tell us that the market is pricing years of incredible growth into Zoom’s future.

That is where I get very concerned. I don’t see how Zoom’s growth won’t quickly be shut down by deep-pocketed competition.

The big boys are coming after Zoom with videoconferencing offerings of their own.

Alphabet‘s (Nasdaq: GOOGL) Google, Facebook (Nasdaq: FB), Microsoft (Nasdaq: MSFT), Cisco Systems (Nasdaq: CSCO) and a host of other companies have all cranked up their focus on videoconferencing.

These companies have seen the waves of people and companies flocking to Zoom, and they want a piece of the action.

I think they are going to get it. There is really no reason to use Zoom if equal or better videoconferencing alternatives exist – especially if the other offerings are less expensive.

How will Zoom fare in a price war with Google or Microsoft?

[Alert: New Technology Could Put Millions Out of Work while also Creating Many Millionaires]

These big competitors have the huge advantage of being able to bundle their videoconferencing software with their other offerings.

The only response that Zoom will have is to lower prices – and that will have an immediate impact on the financial performance of the company, which will in turn hit Zoom’s stock price.

Zoom’s lack of a protective moat will eventually be the killer for the stock.

The higher the valuation, the bigger a stock’s protective moat needs to be. And Zoom’s moat simply doesn’t justify its current valuation.

That means Zoom shares are a risky proposition today.

Good investing,

Jody

Leave a Comment