It’s a whole new world out there…

I never thought we’d see a global pandemic of this scale. And for a while, I couldn’t see the light either.

But it’s the circle of life. Stocks rise and fall. Markets crash and are reborn.

And sometimes – amid all the panic – investors are able to pick up super-cheap shares of iconic, trailblazing companies…

Like The Walt Disney Company (NYSE: DIS).

And today, I’m going to explain why I think the House of Mouse is still a “Buy.”

Into the Unknown

I’ve learned a lot of valuable lessons since I started investing.

An important one is “Be prepared.”

[Breakthrough: How the Son of a Police Officer Shocked the World With This Tiny $3 Stock]

So when the markets jumped off a cliff in March, I had a mental wish list of stocks I knew I wanted to buy at a discount.

Disney was one of them.

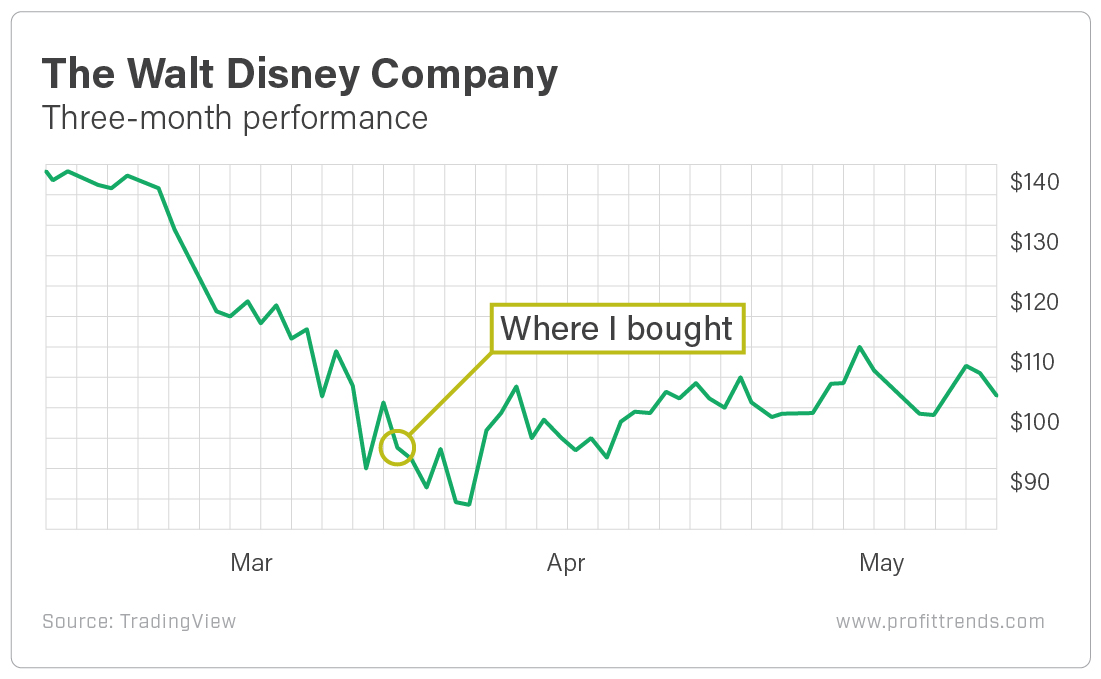

On March 16, I picked up shares at $95.04. That was 38% off their all-time high!

In a moment, I’ll explain why I jumped on the chance to buy the media giant.

But first, I’ll address why some analysts are afraid to wish upon this particular star.

Can’t Let It Go

The short-term outlook is bleak…

Five out of six parks and resorts are closed until further notice. A whopping 100,000 poor, unfortunate souls have been furloughed, and executives have taken salary cuts.

Cruises lie abandoned in ports.

ESPN has no new games to broadcast.

Expected box-office hits like Mulan and Black Widow have been postponed.

And – the icing on the cake – Disney’s dividend has been suspended.

So financially, things have been better.

Revenue still showed 21% growth year over year, but earnings fell 93%. Free cash flow fell 30% to $1.9 billion.

The Parks, Experiences and Products segment was the worst hit, reporting a 58% drop in operating income. The company reported a $1 billion loss in revenue in this segment thanks to COVID-19.

You’ll need more than a spoonful of sugar to help that go down.

[Inspirational: He Started With $7,500 and Now Signs Billion Dollar Deals With Titans of Tech]

Disney isn’t out of the woods just yet, but it has put extensive cost-cutting measures in place to minimize the carnage in its fiscal third quarter.

The Only “Plus” to Being Quarantined

Park profits may be suffering, but Disney’s Direct-to-Consumer & International segment nearly quadrupled in its last report. Segment revenue came in at $4.12 billion.

As of the start of May, the company’s streaming service, Disney+, had 54.5 million paid subscribers. This is hypergrowth in action!

Originally, Disney’s goal was to reach between 60 million and 90 million paid subscribers by 2024. It will likely hit the low end of that goal by the end of the month… four years early!

Not to mention, Disney+ has a huge catalyst on its horizon…

Wait for it…

Just two days ago, we heard that Hamilton will be released to Disney+ on July 3.

The filmed version of the Tony Award-winning musical was originally set to hit theaters in October 2021. But the pandemic has introduced a heightened need for at-home entertainment.

If this isn’t a “making lemonade out of lemons” situation, I don’t know what is.

Won’t You Be Our Guest Again?

Thankfully, the lights are coming back on in Cinderella’s castle.

This Monday, Shanghai Disneyland reopened after a 15-week shutdown. And per Chinese government guidelines, it’s bare necessities only.

Parades and fireworks displays, which would cause crowding, have been canceled. The park has also shut down interactive children’s play areas and live shows.

[Revealed: This Three Dollar Stock is Now a Hidden Gem Trading Under a Secret Name]

Rules and procedures are in place for mandatory masks, temperature screenings and social distancing.

Still, tickets sold out in just minutes.

According to CEO Bob Chapek, Disney plans to increase park capacity by 5,000 people each week until it hits the 30% limited capacity figure set by the government.

“We’re going to see how it goes,” Chapek said. “This is a first step, it’s a baby step, but we’re very encouraged by what we’re seeing in Shanghai.”

Hakuna Matata…

It means no worries. So worry, I won’t.

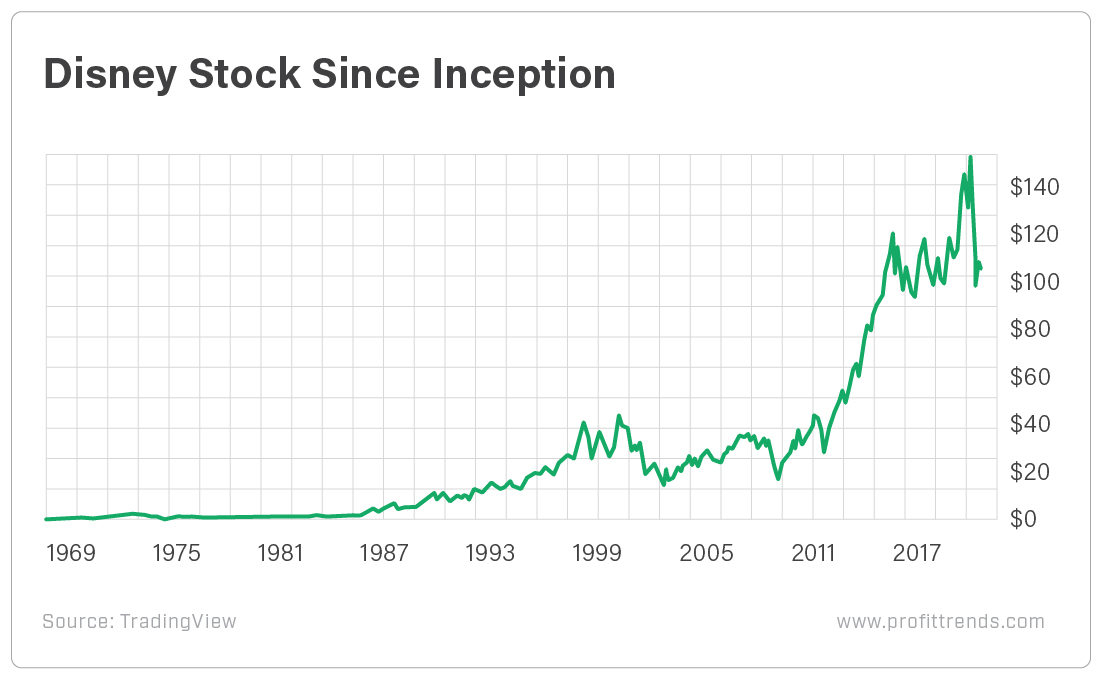

For some perspective, let’s look at a bird’s-eye view of Disney stock since inception…

In short, we are nowhere near panic territory.

Plenty of companies out there don’t have the resources to survive this pandemic. They didn’t adapt to the digital world fast enough… or their model has been deemed obsolete by the changing tides of the pandemic.

But Disney is not one of them.

[Breakthrough: How the Son of a Police Officer Shocked the World With This Tiny $3 Stock]

Besides, my professional, technical, data-derived analysis is this…

It’s freaking Disney.

The behemoth owns ESPN, Hulu, Marvel, Twentieth Century Fox, National Geographic, Pixar, ABC and Lucasfilm… not to mention Disney Music Group, Hollywood Records, Walt Disney Studios, Mickey Mouse and dozens of other household names and franchises.

This giant isn’t going anywhere.

That’s why I’m confident Disney is still a “Buy.” And I believe it will recover from the 2020 slump that the global economy is suffering through.

So I’ll keep picking up shares of great companies while they’re massively discounted. That’s the ultimate benefit of corrections, crashes and recessions.

It’s a tale as old as time.

Good investing,

Rebecca

[Inspirational: He Started With $7,500 and Now Signs Billion Dollar Deals With Titans of Tech]

Leave a Comment