In the future, I believe every asset will be tokenized.

That means stocks, bonds, titles of ownership, music rights – everything of value – will have their ownership rights secured by a blockchain.

That’s because in the future, decentralized technology will evolve into the third generation of the internet, called Web 3.0.

This version of the internet will combine the power of blockchain applications (like bitcoin, Ethereum, and many others)… artificial intelligence… and cutting-edge computer technology.

And with Web 3.0, we’ll send more than just data to other people… we’ll send assets, too. All with the click of a mouse and without needing a third party to manage the transaction.

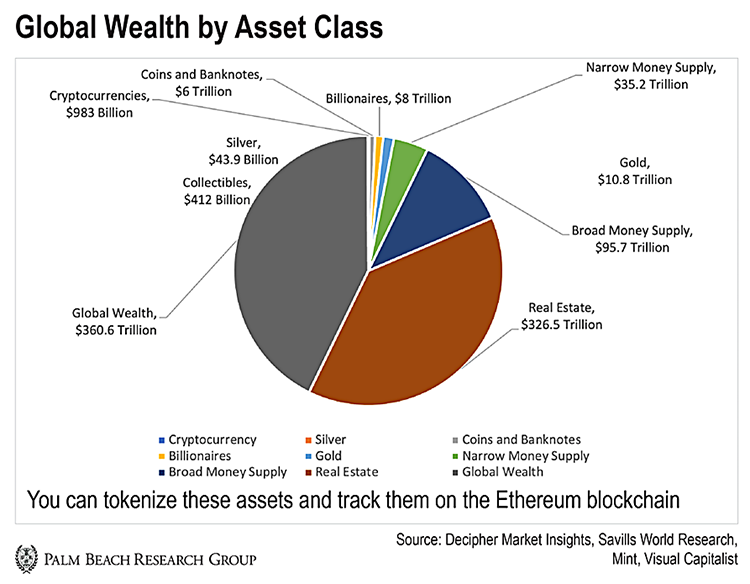

We’ll be able to do things like lend or borrow money, transfer real estate, and even auction fractions of the value of famous paintings… and it will affect nearly all of the $844 trillion in assets worldwide.

To be clear… these transactions will still be secured, verified, and tracked.

But instead of passing through a bank or lender, nearly every transaction that flows on Web 3.0 will go through a tamper-proof blockchain application…

Like a “digital tollbooth,” these applications will charge a fee every time a token exchanges hands… and the owners of these tollbooths – everyday investors like you and me – will collect the profits.

Let me explain…

The “Tollbooth” of Web 3.0

Even if you’re new to crypto, hearing “Ethereum” is like hearing Walmart or Home Depot. Along with bitcoin, it’s the “boring” blue-chip of the crypto world.

It’s no longer the sexy altcoin I recommended at $9 in 2016.

[Whitney Tilson: Gold 2.0 Tap Into the Most Lucrative Vein of the SWaB Revolution]

But as the digital tollbooth at the center of Web 3.0, it’s poised for at least 10x growth from current prices as it evolves over the coming years.

Ethereum is the world’s most widely used blockchain development platform… and it hosts over 37,000 decentralized applications (called “dApps”) – the most of any blockchain.

That’s a tenfold rise in applications since early 2020.

On top of that, nearly 4,000 active developers are working on the Ethereum network… That’s a 74% jump in two years.

But Ethereum isn’t just an ecosystem for dApps. It’s also at the heart of decentralized finance (DeFi).

As you probably know firsthand, finance companies are the ultimate middlemen.

They borrow money cheaply from one party and lend it to another at a fat profit. They buy stock from one group of investors, then immediately sell it to another.

All the while, they catch a middleman spread (the difference between the buy and sell prices).

According to analyst estimates, the finance sector extracts over $9.28 trillion annually from the global economy… That’s more money than the utilities, communication services, and real estate sectors combined.

But DeFi will turn that model on its head and replace a high-cost middleman with a low-cost one.

Take the real estate sector, for example…

A typical real estate transaction involves agents, brokers, lawyers, and insurers. But Ethereum has the capability to replace each of those middlemen with “smart contracts.”

A smart contract will automatically execute the deal if it meets all the sale’s conditions – at a fraction of the cost of a traditional real estate transaction.

And if the smart contract executes on Ethereum, the parties will pay a small fee in its native token, ether…

Eventually, Ethereum will make banking, borrowing, lending, and investing cheaper and more accessible for billions of people.

And its application in Web 3.0 will eventually transition us from a “centralized middleman” economy to a “decentralized service” economy.

So by simply holding the crypto, the average investor can collect some of the fees paid out in these transactions…

[James Altucher’s Investment Network: Coiled Cryptos To Make A Fortune]

The Gateway to $844 Trillion in Tokenized Assets

Based on my research, it’s clear that Ethereum will eventually be the world’s most important global trade network.

It will be at the heart of nearly every Web 3.0 transaction… and we’re already seeing it used for tokenization in the collectibles space.

Let’s say a seller owns a painting valued at $100,000…

Using a tokenization platform, today the owner can divide the painting into 10,000 fractions… with each fraction consisting of a crypto token worth $10.

If the painting later sells for $1 million at auction, then each token would be worth $100.

By tokenizing the painting, the seller can create a record for ownership… And multiple people can buy a stake in the painting.

So thanks to tokenization and Ethereum, the average investor can now profit from a market formerly limited to the ultra-rich.

Now, if you think the tokenization of art sounds familiar, that’s because it is… The key to tokenizing these assets is NFT technology (non-fungible tokens).

But before you roll your eyes and write off NFTs as a fad, you need to understand that there’s more to them than “CryptoPunks” or “Bored Apes.”

Using NFT technology to secure ownership rights to digital art was only the first use case – similar to how the first widespread use case for the internet was email.

And like we use the internet for much more than sending emails today… The same will hold true for NFT technology in the future.

That’s because you can tokenize and trade nearly any asset class on Ethereum using NFT technology and smart contracts.

As you can see in the chart below, we estimate the combined value of all global assets to be about $844 trillion.

In time, I expect Ethereum to swallow up these assets. And we’ll see the price of ether skyrocket along with it.

If just 1% of the world’s assets become tokenized on the Ethereum blockchain, it would generate roughly $22.8 billion in network fees annually.

If we put that in terms of a similar high-growth tech company like Amazon or T-Mobile, that puts Ethereum at roughly $20,505 per token.

That’s a 1,211% increase – more than 10x – from today’s price…

Web 3.0 Is Not a Fad

Friends, I understand crypto is in a bear market. It’s probably the most-hated asset class in the world right now.

In your gut you know that’s the best time to buy world-class assets like Ethereum – when they’re insanely cheap… yet poised for incredible growth.

Just imagine a world where almost everything is publicly traded… every house… every car… every piece of art… every restaurant… every best-selling novel.

Now picture a world where you can take a direct stake in any of those things.

That’s the future Ethereum offers.

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

When we eventually transition into Web 3.0, investors who position themselves in Ethereum now will reap the biggest rewards.

If you don’t already own it, consider picking up some Ethereum today… And remember, in crypto, you don’t need a lot to make a lot. So don’t bet the farm on any one idea.

Let the Game Come to You!

Big T