In February 2020 – right before Covid reached America’s shores – I gave a private talk to a room full of entrepreneurs.

During the talk, I warned them that crippling inflation was coming.

I told them to go out and buy rare, hard assets like trophy real estate, collectible watches, and blue-chip art.

I urged them to buy things wealthy people would want to own in the future.

These investments were hardly a secret for Daily readers. I’ve been pounding the table on collectibles for subscribers since 2019.

And a key sign from the Federal Reserve told me my assessment was correct.

That sign came on March 15, 2020. That’s when the Fed said it would restart its quantitative easing program.

It committed to buying $500 billion in Treasuries and $200 billion in mortgage-backed securities.

At this point, I knew the Fed was in a full-flight panic about the economy.

I predicted it would print stadium-sized stacks of money to paper over the effects of the pandemic.

And by April 2020, the Fed and Congress started printing their first $1,200 stimulus checks. Eventually, the total spending would balloon to the tune of $13 trillion.

That was the kickoff for what I call a New Order of Money.

For most people, this New Order means pain. That pain will come in the form of a real and persistent loss of the purchasing power of their money due to rising inflation.

So traditional retirement vehicles like cash, stocks, and bonds just won’t cut it anymore.

Instead, why do hard assets take off during high inflation?

It’s pretty simple. They’re real, rare and enduringly valuable.

So as inflation ramped up in late 2020, I expected the ultra-wealthy to run to hard assets. And that’s exactly what they’ve been doing.

In a moment, I’ll tell you what assets they’re flocking to – and why I refer to them as Maverick Investments.

Maverick Investments are real, rare and enduringly valuable assets. And for those reasons, I expect them to outpace inflation.

Before I get to them, let me tell you why persistent inflation is here to stay…

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Why Persistent Inflation Is Here to Stay

Over the past few years, we’ve seen massive money printing by the government.

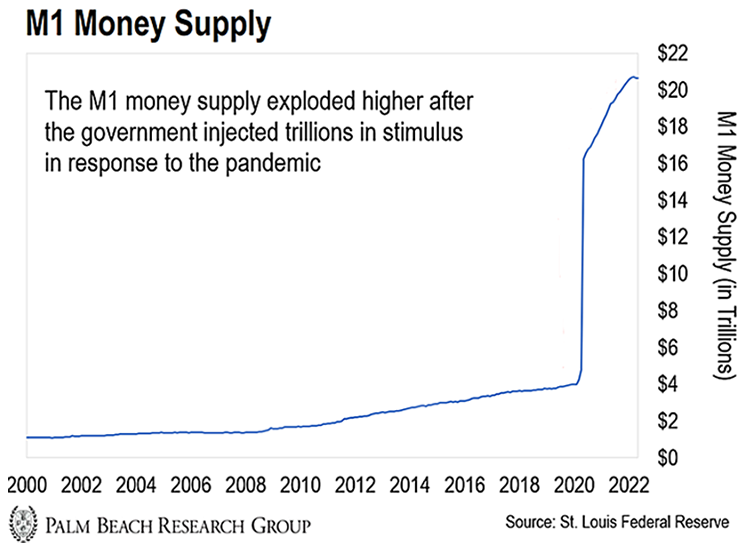

Just take a look at the chart below. It shows the exponential rise in the M1 money supply starting in 2020.

The M1 money supply is the total volume of currency held by the public in a country’s economy.

We’ll continue to see politicians create trillions of dollars out of thin air as they embrace what I call “Free Lunch Theory” (FLT).

The rate of money the federal government is pumping into the economy has slowed since the early days of the pandemic. But some states are still handing out “inflation checks” to offset higher prices.

When you hand out checks to help people with higher prices with no thought of the consequences… that’s Free Lunch Theory in a nutshell.

The irony of FLT is by giving out more money, you just stimulate demand – which in turn keeps prices high.

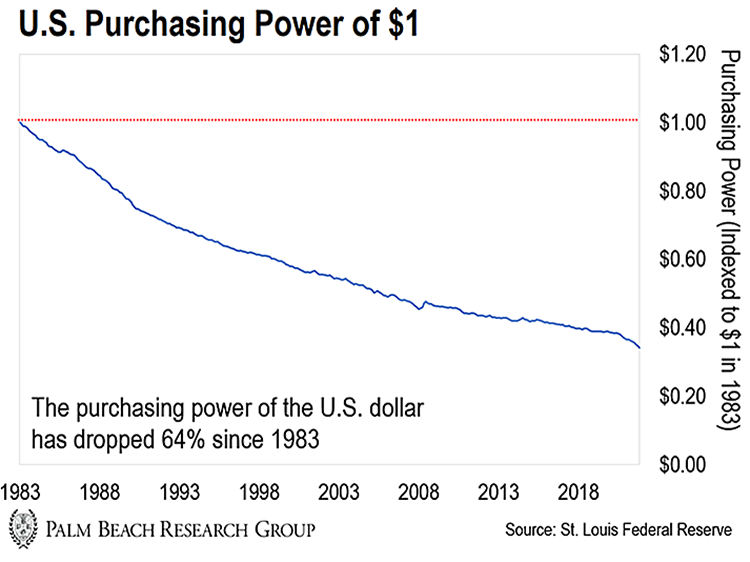

More government spending will cause prices to rise, which will continue eroding your purchasing power as you can see in the chart below.

[The $4 Inflation Stock That Can Change Your Life – Whitney Tilson’s Latest Prediction]

The fact of the matter is, our political leaders just don’t get it.

Inflation remains a monetary phenomenon. And interest rates are still under the rate of inflation.

That means we’re not even really beginning to tighten yet… and we’ve got a long way to go.

The U.S. dollar has already lost a staggering 64% of its purchasing power in the last 40 years. And although the rate of government spending has slowed, it’s still increasing.

Here’s the thing to remember: The government has shown again and again it has no stomach for hardship.

That means if the economy seriously weakens, you’ll see government spending ramp back up, and the Fed will have no choice but to lower rates.

This, of course, will reignite out-of-control inflation. No matter what happens, we keep coming back to the vicious spiral of inflation.

That is why it’s so important to have your Maverick Investments in place now before the Fed pivots back to its easy-money policies.

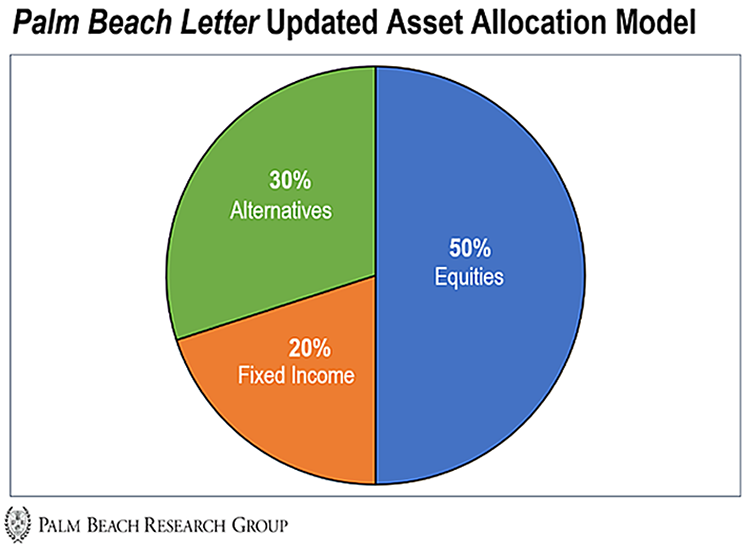

Maverick Investments exist outside the standard “60/40” model of stocks and bonds. I like them because they contain three important traits…

- Real: The harder it is to “print” an asset… the more real it is.

- Rare: These are assets with low supply.

- Enduringly desirable: These are assets with a history of having high demand from wealthy people.

When money becomes too abundant (via inflation), it seeks out real, rare, and enduringly desirable assets.

I’ve added these types of Maverick Investments to our portfolio since I took over The Palm Beach Letter in 2016.

Over that time, we’ve earned an average annual return of 144%. That’s compared to the 10% you’d get in the S&P 500.

So by using this strategy, we’ve crushed the broad market by nearly 14x.

And right now, one of my favorite Maverick Investments to outpace inflation is collectibles.

[Biden Bucks: Executive Order 14067 could pave the way for a social credit system just like China]

The Case for Collectibles

Inflation will be with us for many years. It might ebb and flow from one quarter to the next, but it’s here to stay.

This is why we’re following the ultra-wealthy’s lead and using collectibles to combat inflation. And as you’ll see, you don’t have to be ultra-wealthy to get a piece of the pie.

Collectibles serve the goal of inflation protection, and with lower volatility than stocks.

That’s why they’re a key part of our alternatives portfolio… which I expanded when my team simplified our asset allocation model in July.

In today’s high-inflation market, alternatives like collectibles can give you high returns over time, and often with lower volatility.

But I’m not recommending collectibles because the wealthy are buying them. I’m recommending them because that’s where great returns lie.

That’s because the best collectibles are real, rare and enduringly valuable – making them the perfect Maverick Investments.

Take the sports memorabilia industry, for instance.

The sports memorabilia market generated a record $10 billion in sales in 2021. That’s an 85% jump from the $5.4 billion it generated in 2020.

While conventional assets like stocks and bonds have suffered massive losses this year, collectibles like contemporary art and fine watches are up.

I know everyone can’t buy fine art or luxury watches. That’s why in Tuesday’s issue, I’ll share with you my favorite platform that allows Main Street investors to get exposure to some of the highest-quality collectibles on the market.

I’m talking about rare baseball cards, luxury watches, art masterpieces, and even vintage cars. Best of all, in some cases, you can get started with as little as $50.

Let the Game Come to You!

Big T

[Jim Rickards Asset Emancipation: Profit from the 3 Companies Building “Biden Bucks”]

Leave a Comment