Wide adoption of technological innovation – such as the fifth generation of cellular technology (5G) – offers investors opportunities to invest in technology stocks that are best positioned to take advantages of the upcoming boom.

While cellular technology has been around for decades, 5G promises leaps in communication speeds and data transfer capacity. Transmission rates of the new 5G networks data will be 10 to 100 times faster than the current 4G technology. The exponentially faster transmission speeds will certainly offer better gaming and video streaming services. However, the impact of the 5G technology should expand far beyond pure entertainment purposes.

Even with just the entertainment application, the 5G technology has potential to drive strong corporate growth and consequently benefit investors that have stakes in the 5G-related technology stocks. However, the high transmission speeds and low latency of 5G networks could finally remove the remaining barriers to widespread application of the Internet of Things (IoT).

Thanks to 5G technology, some marvels of technology relegated solely to science-fiction works over the past century could become ubiquitous in our daily lives over the next couple of decades. These technologies will encompass interconnected transportation systems – including autonomous cars –, “smart” homes, instant medical diagnostics and new categories of industrial applications to increase manufacturing efficiencies and availability of information.

[Read More: Best-Selling Author Bill O'Reilly Has His Own Ideas About the 5G Revolution]

Some of the existing and well-known technology stocks have delivered strong growth from leveraging the new technology to their advantage. Until new companies emerge to take advantage of 5G proliferation and become market leaders, investors can enjoy robust gains offered by existing technology stocks.

In a sector where more than one third of equities delivered one-year losses, these three large-cap technology stocks – average capitalization of $150 billion – delivered robust total returns driven by asset appreciation and rising dividend income. Sorted in ascending order by their one-year total return, the three technology stocks below could continue to benefit significantly from the current boom and 5G technology implementation.

3 Stocks to Take Advantage of the 5G Technology Boom: #3

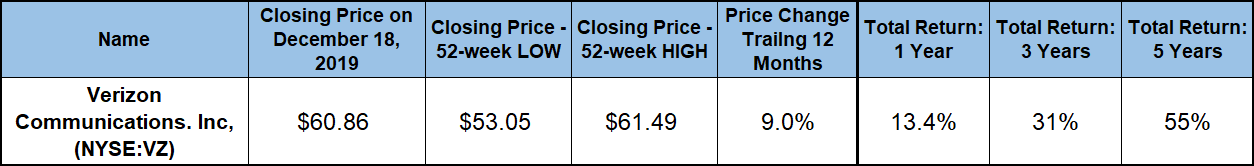

Verizon Communications, Inc. (NYSE:VZ)

While experiencing moderate volatility over the past 18 months, the company’s share price has recovered all intermediate losses and has gained approximately 40% since March 2018. Coming into the trailing 12-month period on the tail end of a 20% pullback in the last-quarter 2018, the share price dropped to its 52-week low of $53.05 on December 24, 2018.

After a trend reversal at the end of 2018, the share price still experienced a moderate level of volatility but maintained an overall uptrend. By late November 2019, the share price recovered all its fourth-quarter 2018 losses and set a new all-time high of $64.49 on December 17, 2019. At the end of the subsequent trading session on December 18, the share price closed marginally lower at $60.86. Just 1% below the all-time high, the December 18, closing price was 9% higher than it was one year earlier and nearly 15% above the 52-week low from the end of December 2018.

[Read More: Best-Selling Author Bill O'Reilly Has His Own Ideas About the 5G Revolution]

After six years of flat annual dividend distributions from 1999 to 2004, Verizon delivered 14 consecutive annual dividend boosts. A 60% dividend advancement over that period corresponds to a 2.4% average growth rate. The company’s most recent dividend boost raised the quarterly payout 2% from the $0.603 quarterly dividend amount in the same period last year to the current $0.615 distribution. This new quarterly dividend payout amount is equivalent to a $2.46 annualized distribution and a 4% forward dividend yield.

The dividend payouts and asset appreciation combined to deliver a 13.4% total return over the last year. Additionally, longer-term total returns over the past three and five years were 31% and 55%, respectively.

3 Stocks to Take Advantage of the 5G Technology Boom: #2

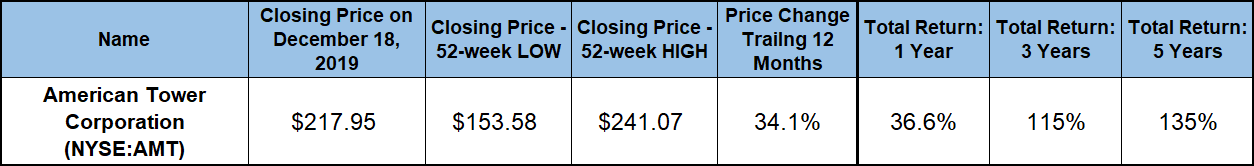

American Tower Corporation (NYSE:AMT)

Following a double-digit percentage pullback driven by the overall market correction in the last-quarter 2018, the company’s share price reached its 52-week low of $153.58 on December 24, 2018, which was in the first week of the current trailing 12-month period. However, as soon as the downward pressure from the overall market correction subsided, the share price reversed direction and embarked back on its long-term uptrend that delivered a asset appreciation of more than 100% over the past five years.

[Read More: Best-Selling Author Bill O'Reilly Has His Own Ideas About the 5G Revolution]

After bottoming out at the end of December 2018, the share price rose quickly and regained all its losses from fourth-quarter 2018 by the third week of January 2019. Setting a series of new all-time highs along the way, the share price continued its uptrend towards its most recent all-time high of $241.07 on September 7, 2019. After setting the new all-time high in September, the share price gave back 15% of its value over the subsequent two months. However, after another trend reversal in early-November, the share price surged again to close at the end trading on December 18, 2019 at $217.95. Despite trailing the September peak by more than 9%, the December 18, share price was 34% above the level from the beginning of the trailing 12-month period, as well as 42% above the 52-week low from the end of 2018.

In addition to the robust asset appreciation, the American Tower Corporation also rewarded its shareholders with rising dividend income payouts. The company has boosted its dividend payout every quarter since April 2012. Over that period, the quarterly payouts advanced at an average growth rate of 5.2% each quarter, or 20.6% per year.

While asset appreciation remains the main driver behind shareholder returns, dividend income contributed a small share toward the company’s total return of nearly 37% over the last year. However, the shareholders more than doubled their investment over the three-year period with a total return of 115%. Over the past five years, the total return reached nearly 135%.

3 Stocks to Take Advantage of the 5G Technology Boom: #1

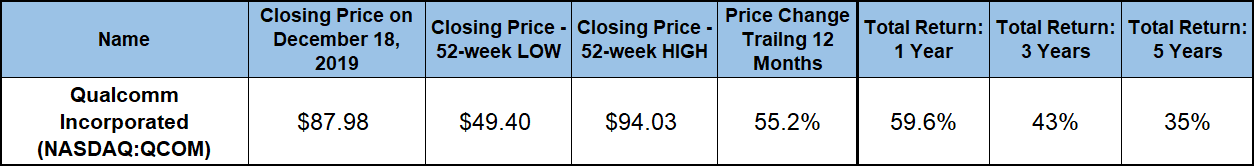

Qualcomm, Inc. (NASDAQ:QCOM)

Qualcomm’s share price entered the trailing 12-month period on a downtrend that reduced the share price by nearly 30% in the last-quarter 2018. The downtrend extended into early 2019 until the share price reached the 52-week low of $49.40 on January 29. After bottoming out at the end of January, the share price turned around and began advancing higher. Through moderate volatility, the share price nearly doubled before reaching the new all-time high of $94.03 in early November 2019.

[Read More: Best-Selling Author Bill O'Reilly Has His Own Ideas About the 5G Revolution]

Since peaking on November 19, the share price pulled back 6.4% to close at the end of the December 17 trading session at $87.98. While slightly below the recent peak, the December 17, closing price marked a 55% gain over the trailing 12-month period. Furthermore, the share price has gained 78% since the 52-week low in late-January. A 40% decline in 2015 limited the total asset appreciation to just 16% over the last five years.

Qualcomm’s current $0.62 quarterly dividend distribution is 8.8% higher than the $0.57 distribution from the same period last year. This current distribution corresponds to a $2.48 annualized payout amount and yields 2.8%, which is more than twice the 1.17% simple yield average of the overall Technology sector. Since beginning dividend payouts in 2003, Qualcomm has enhanced its annual dividend amount more than 20-fold, which corresponds to a 19.5% average annual growth rate over the past 17 years.

The recent share price surge and the rising dividends delivered a total return on shareholders’ investment of nearly 60% over the last year. Because of the steep asset depreciation of 40% in 2015, total returns of 43% and 35% over the past three and five years, respectively, were lower than one-year returns.

Leave a Comment