Over the past months I’ve been researching companies that I call tails-you-win, heads-you-win opportunities. These are companies in businesses that profit during good economic times and — more importantly — during terrible economic times. In general, these are great stocks to buy.

And now that the United States is about a month into this coronavirus from China mess, the terrible times are here for a bit.

Every day I’ve been getting more emails from retail and other brick-and-mortar businesses letting me know that they are closing their stores in light of the Covid-19 outbreak. This means that all of those dark stores are now generating nothing.

Unfortunately, these empty stores will be a further strain on their underlying companies. It was bad enough to be a brick-and-mortar business without a global pandemic.

Because just as Walmart (NYSE:WMT) changed the retailer landscape from local shops to the big-box stores built by Sam Walton, Amazon (NASDAQ:AMZN) has been transforming the landscape even more so — I’m talking colossal-scale changes.

An E-Commerce Takeover

In the U.S. and well-beyond, shopping online increasingly is taking the place of visiting retail locations. And even Amazon is being impacted by its own online presence in groceries as its delivery service is taking the hassle of visiting a Whole Foods out of the process.

The result is that retail stores are closing.

[Read More: This 5G Wireless Company is Poised to Become a Global Household Name]

From major malls to strip malls and from main and high streets — stores are now vacant. In 2019, companies announced the closing of 9,300 stores surpassing the record in 2017 of 8,000 closures. And so far in the opening weeks of 2020, 1,900 stores are set to close.

And this is just the start. Real estate behemoth, Cushman & Wakefield (NYSE:CWK), is projecting that store closures will exceed 12,000 for full-year 2020, making the year a bad record for retailers.

This includes announced plans by Pier 1 Imports to close 450 stores, Gap (NYSE:GPS) to close 230 stores and Chico’s (NYSE:CHS) to close 200 stores. We also learned Forever 21 isn’t forever — as it announced the closing of 200 stores. And Walgreens Boots Alliance (NASDAQ:WBA) is also closing 200 stores this year.

But there is an upside.

Closing Deals

Companies have to deal with each and every closing store. Think of the inventories, the fixtures, the real estate and all of the local liabilities.

There’s one company that’s a leader in this space — Great American Group.

Since 2013, Great American Group has closed over 6,800 stores. That amounts to over $13 billion in assets. More importantly, the company is set to explode in 2020 as the closing market is showing no signs of stopping. Great American estimates that 30% of traditional retailers could close down in the not-too-distant future.

The timeline for those closings is only going to speed up, thanks to Covid-19.

So how exactly did I come across this “great” company? Well, I have been researching the realities of the retail apocalypse — who handles store closings and disposing of the facilities? In the process, I tracked down the firm contracted to take care of the stores.

You guessed it. That firm was Great American Group. But my search didn’t stop there — Great American merged into a company I find even more interesting.

My Top Retail Play Now: RILY Stock

That company is B. Riley Financial (NASDAQ:RILY). CEO Bryant Riley is the founder and largest shareholder, owning 27.3% of its shares. And he just added to his pile on recent drops. This company is a great place to start when looking for retail plays, as I like management that has skin in the game.

So what exactly does B. Riley do? It’s a financial firm that operates like a big umbrella, providing the structural underpinnings for six core businesses, and these core businesses are all the results of mergers and acquisitions. As I discussed above, it owns Great American Group. But it also acquired FBR, a specialized investment bank. I am familiar with the name through my days in the banking world.

[See Here: The Company Poised to Make This Decade's Most Brilliant Tech Power Play]

I also happen to like another of its core businesses quite a bit. B. Riley Principal Investments acts much like my alt-financials, such as Hercules Capital (NYSE:HTGC) and TPG Specialty Lending (NYSE:TSLX). Both of those stocks are in one of my Profitable Investing model portfolios.

Its Principal Investments makes loans and takes equity stakes in a variety of companies, and it’s inching out traditional commercial banks. This business works with B. Riley Capital Management in loan origination as well as other direct asset acquisitions.

And in turn, B. Riley Wealth Management utilizes the strengths of FBR to provide asset management, primarily to private clients and family offices. It currently has more than $10 billion in assets under management (AUM).

Lastly, there’s GlassRatner, which dovetails nicely with Great American. GlassRatner specializes in helping failed or failing businesses with restructuring and bankruptcies. It also provides asset valuation, legal counseling and accounting services.

B. Riley and the Retail Apocalypse

Now, valuation, auctioning and liquidation make up a reported 31% of B. Riley’s segmented income. Its Capital Markets and Principal Investment businesses make up the majority of its segmented income.

So, while it is not a pure play on store closings, its other businesses have additional appeal and increase my interest as an investor in RILY stock.

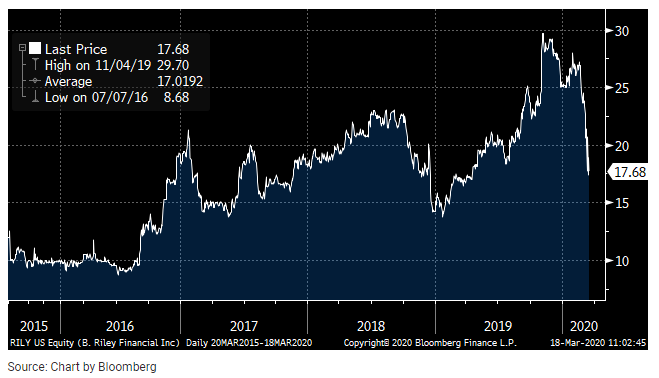

Investors Still Believe in B. Riley (Stock Price)

The shares have generated a gain of 47.3% over the trailing five years. And when you factor in the stock market rout and dividends, RILY stock has a total return of 82.6%. Both of these measures amply outperform the general S&P 500.

[Read More: This 5G Wireless Company is Poised to Become a Global Household Name]

And now it is a very cheap stock. Shares are valued at a discount to its trailing revenues, and that revenue has been advancing by 54.2% over the past year.

B. Riley’s operating margin is huge for an alt-financial, running at 30.5%. This figure in turn boosts the return on shareholders’ equity, which comes in at 26.3%.

And while other public companies are currently in limbo, it’s a pretty easy bet that there will be a lot more store closings this year in the wake of Covid-19.

Meanwhile, the stock trades at a price-book value of 1.3 times, making it a value stock.

It’s also important to note that B. Riley operates with less regulatory oversight than a traditional bank, which is an additional bonus as it builds up its assets. The company’s underlying book value has gained almost 17% per year over the trailing five years on a compounded annual growth rate (CAGR) basis).

And as I noted earlier, the CEO just piled on more stock with his additional purchases in the past week.

Lastly, it has a tremendous amount of cash and equivalents on hand, but management likes leverage to drive returns higher. As such, its debts-assets ratio is higher at 73.1%. This high figure gives me some pause, but provided the company works in both contracting and expanding markets, there are internal business hedges that make it more appealing.

The Bottom Line on RILY Stock

One final thing I always do is run a credit analysis on companies that I recommend in my Profitable Investing. And with the fallout from the coronavirus, I have been digging again into the debts of each of my holdings.

B. Riley’s loans are primarily due for rollovers in 2023. And credit lines are amply available. Its current credit crunch isn’t much of an issue for the company, especially as it also uses preferred shares for funding. Those preferred shares have call dates that extend out much further.

I also want to note that RILY stock has a history of both regular and special dividends, which give it an annual yield of 10.1%. Its distributions have been climbing by 125.8% on average over the trailing five years.

[See Here: The Company Poised to Make This Decade's Most Brilliant Tech Power Play]

I am recommending it as a “buy” as it is a current bargain. RILY stock is a great way to capitalize on what’s wrong in the markets and what will eventually go right. Buy it now in a tax-free account.

Read more from Neil George at InvestorPlace.com

Neil George was once an all-star bond trader, but now he works morning and night to steer readers away from traps — and into safe, top-performing income investments. Neil’s new income program is a cash-generating machine … one that can help you collect $208 every day the market’s open. Neil does not have any holdings in the securities mentioned above.

Leave a Comment